unlevered free cash flow vs free cash flow

I invite you to subscribe to my YouTube channel at the link below. Levered vs Unlevered Free Cash Flow.

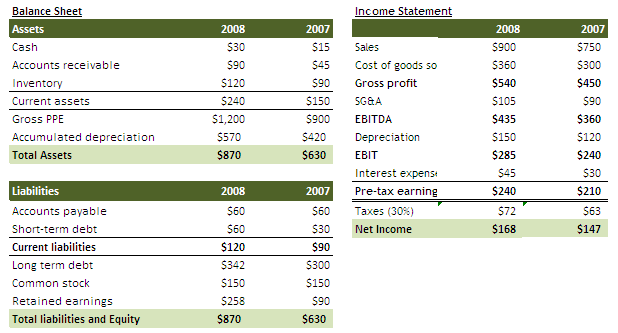

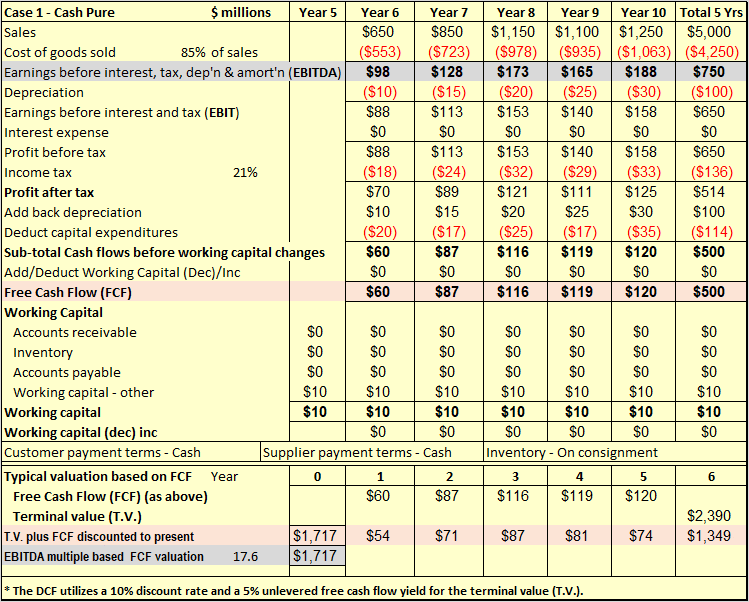

Free Cash Flow Meaning Examples What Is Fcf In Valuation

The look thru rule.

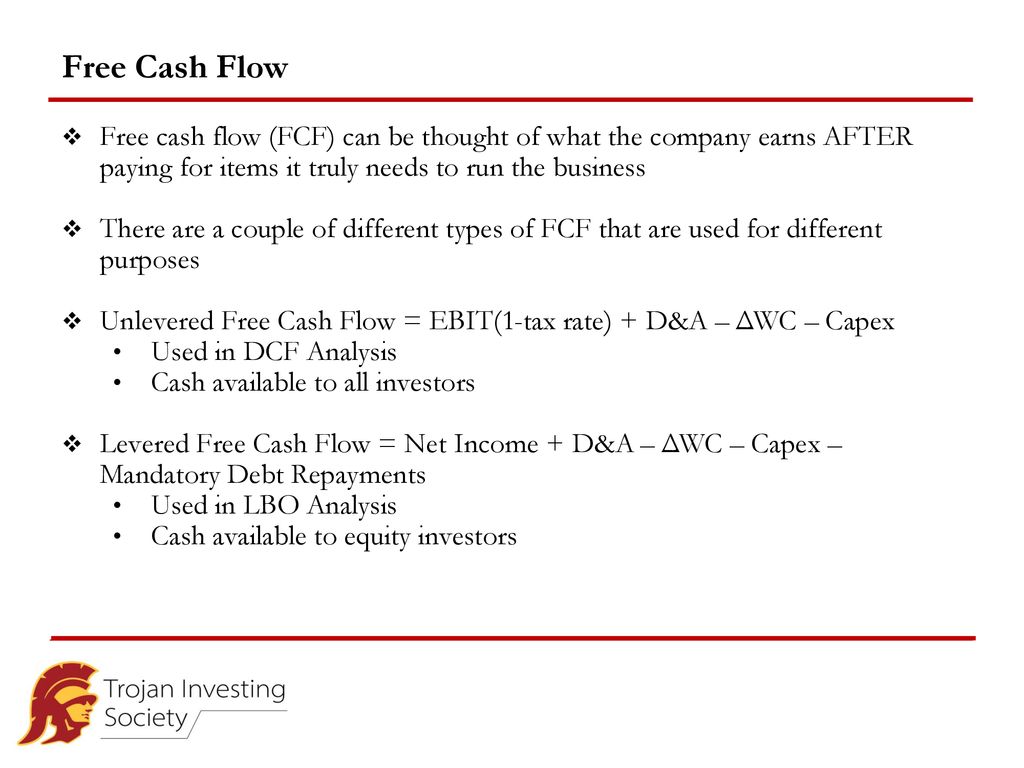

. Unlevered Free Cash Flow UFCF Levered free cash flow LFCF is the amount of money a company has after deducting the amounts payable towards. Levered Free Cash Flow LFCF vs. It is the cash flow available to all equity holders and.

It represents cash available to all capital providers. Levered free cash flow yields are typically higher than unlevered ones because they consider. Unlevered free cash flow is the cash flow a business has excluding interest payments.

Internal Revenue Code that lowered taxes for many US. Think about these types of cash flow in terms of a before and after state. The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted.

What is unlevered free cash flow. For this scenario unlevered free cash flow is the before state and levered free cash flow is the after. Unlevered free cash flow UFCF is an anticipated or theoretical figure for a business that represents the cash flow remaining before all expenses interest payments and.

It excludes taxes capital expenditures and changes in non-cash. Unlevered free cash flow. A complex provision defined in section 954c6 of the US.

Unlevered Free Cash Flow - UFCF. Unlevered Free Cash Flow Yield EBITDA CAPEX Working Capital Taxes. Unlevered free cash flow.

In other words it deducts. Essentially this number represents a companys financial status. Unlevered Free Cash Flow is the cash generated by a company before accounting for interest and taxes ie.

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered cash flow is the amount of cash flow generated from business operations. The basic difference is that Levered Free Cash Flow represents the cash flow available only to the common shareholders in the company rather than all the investors.

Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

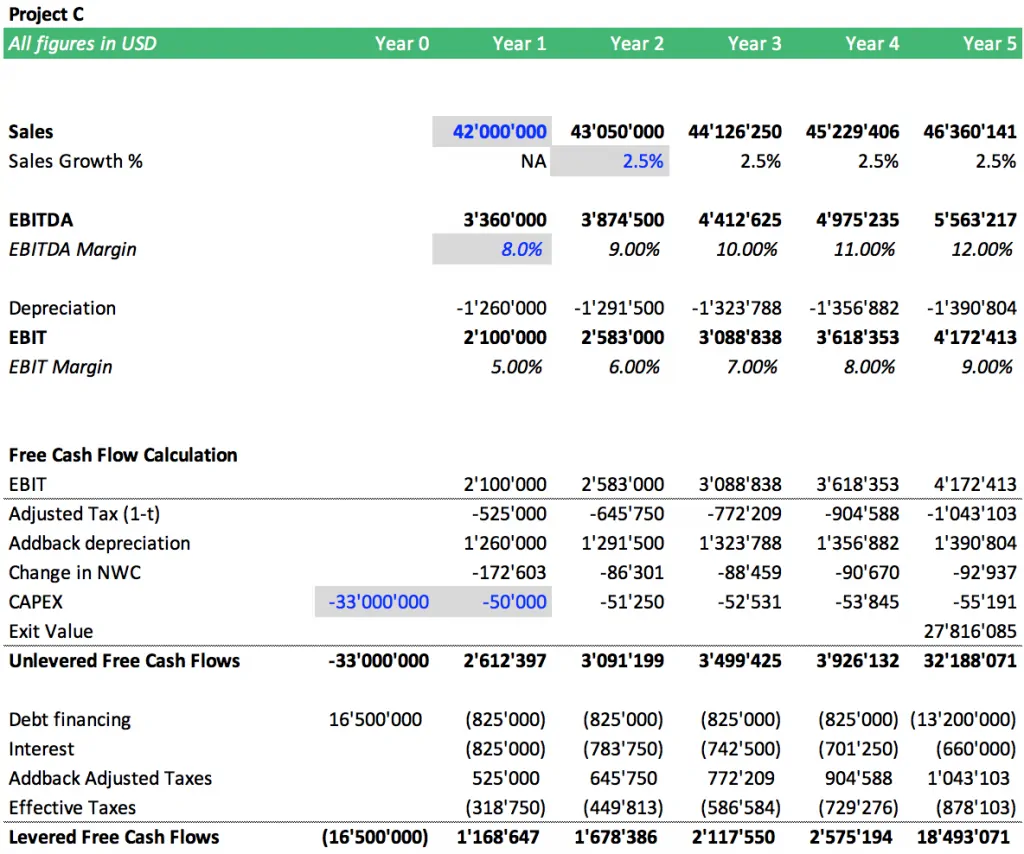

Irr Levered Vs Unlevered An Internal Rate Of Return Example Efinancialmodels

How To Value A Company Using Discounted Cash Flow Analysis Dcf Stockbros Research

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

What Is The Difference Between Fcff And Cash From The Cash Flow Statement Quora

Investment Banking Bootcamp Week 3 Accounting Ppt Download

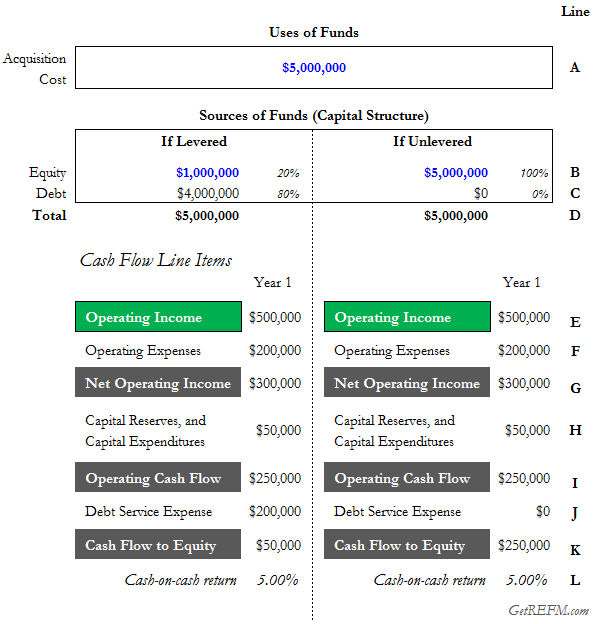

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Free Cash Flow Levered And Unlevered Free Cash Flow Bankingprep

Free Cash Flow Yield Formula And Calculator

During A Valuation For A Lbo Should The The Free Cash Flow Be Levered Or Unlevered Quora

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

What Is Unlevered Free Cash Flow Ufcf In Real Estate Leverage Com

Levered Free Cash Flow Tutorial Excel Examples And Video

What Is Free Cash Flow Calculation Formula Example

Free Cash Flows Let S Have A Discussion Towards A Better Understanding Seeking Alpha

Unlevered Free Cash Flow For Dcf Modeling Keyskillset

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐫𝐞𝐞 𝐂𝐚𝐬𝐡 𝐅𝐥𝐨𝐰 𝐅𝐂𝐅 𝐚𝐧𝐝 𝐇𝐨𝐰 𝐭𝐨 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐞 𝐈𝐭 Accounting Drive

Unlevered Free Cash Flow Definition Examples Formula

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download