nc state sales tax on food

Get a Copy of a Tax Return. Individual Income Tax Returns With Extensions Are Due On Oct.

A State By State Guide To Sales Tax On Candy Just In Time For Halloween

For additional information check out Louisianas website.

. All remote sellers having gross sales in excess of one hundred thousand dollars 100000 sourced to North Carolina or two hundred 200 or more separate transactions sourced to North Carolina in the previous or current calendar year collectively Threshold must register to collect and remit sales and use tax to North Carolina effective November 1 2018. Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board. Find a Job in NC.

A few highlights from around the state of North Carolina. Not exempt from MN sales tax on food beverages and lodging. State Local and Tribal Governments.

The Louisiana state sales tax rate is currently 445. Prepared food is taxed at the higher rate of 9 percent. Maine has state sales tax but does not have local sales tax.

Learn how to get each one. If a Florida dealer sells to a purchaser in a county without a discretionary surtax only the base state sales tax is charged on the purchase regardless of whether the dealers county assesses a discretionary surtax. North Carolina Sales Tax.

To file your federal tax return you can look into tax preparation software or hire a professional accountant. NC Sales Use Tax Technical Bulletin 17-2. Business owners should thoroughly research the requirements for registering in any state where they do business before completing any forms or providing credit card information to a third.

Semiannual refund of NC state sales and use tax. Send the completed form to the seller and keep a copy for your records. Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity.

20301 Mail Service Center Raleigh NC 27699-0301. Do Business in NC. State Tax Forms.

Surplus Sales by State. Mail the following items to get an exact copy of a prior year tax return and attachments. Find a complete.

X Research source New Hampshire for example has no general sales tax but still taxes restaurants food services hotels room rentals and motor vehicle rentals at 9. Featured In the Spotlight. Find contact information and major state agencies and offices for the government of North Carolina.

You typically have sales tax nexus in the state of Maine if you have. You may need a copy or a transcript of a prior years tax return. If NC sales and use tax is incurred for direct purchases by the University of tangible personal property contact Controllers Office to initiate request for a refund via Form E-585.

Download your states tax forms and instructions for free. Find NC State Services. Prepared Food and Beverage Return and Instructionspdf One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina.

These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic. For accurate and reliable information about obtaining a North Carolina sales and use tax number visit the Revenue Departments Sales and Use Tax webpage. Apply for Food Stamps.

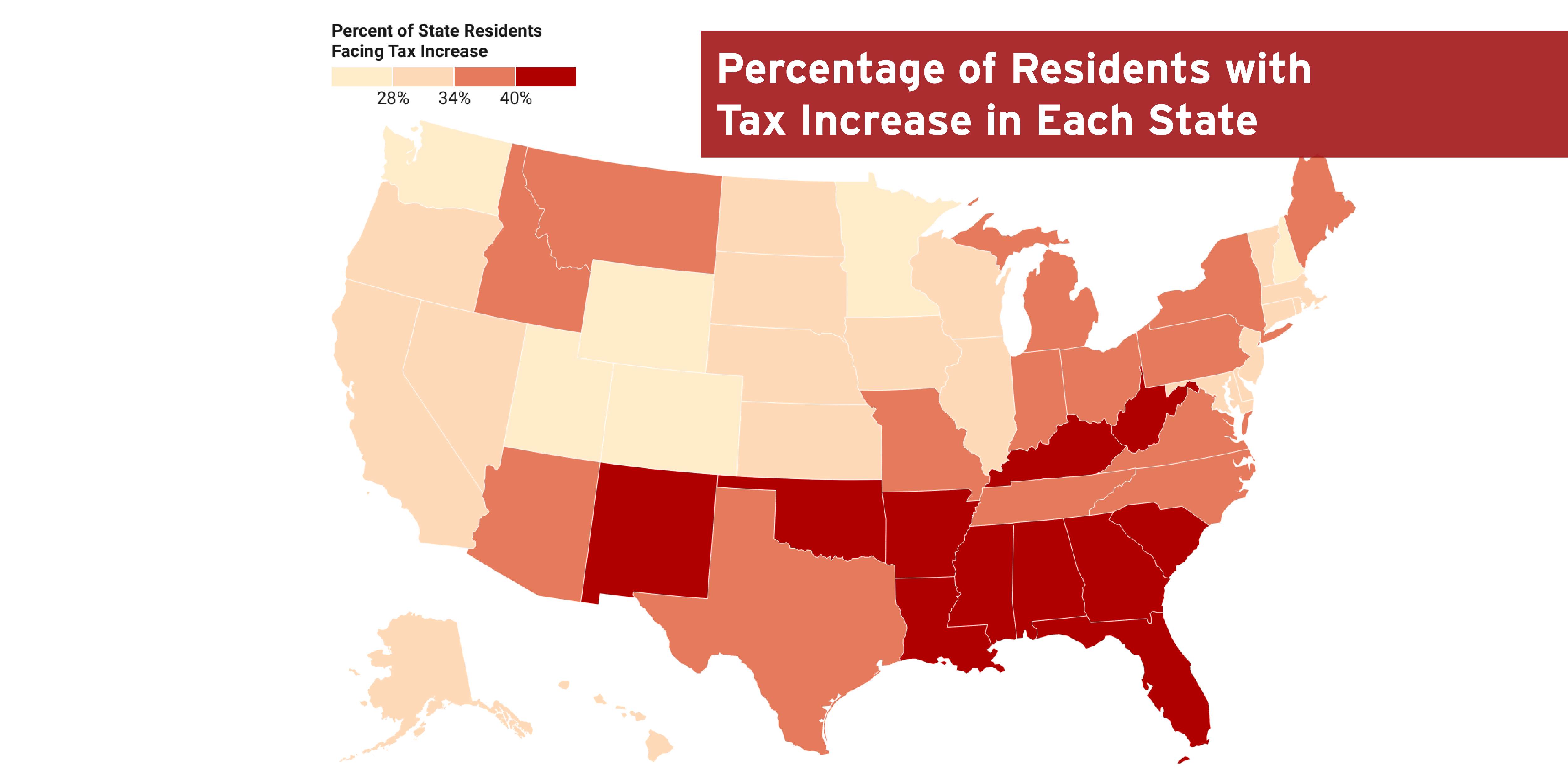

In addition to that statewide rate every county in North Carolina collects a separate sales tax which ranges from 2 to 225 in most counties. A state or district such as District of Columbia may have a general sales tax of 6 but set the tax rate on liquor and prepared food at 10. The base sales tax in North Carolina is 475.

Get Copies and Transcripts of Your Tax Returns. Depending on your locality the total tax rate can be as high as 85. 08 Real estate 09 Rental and leasing 10 Retail trade 11 Transportation and warehousing 12 Utilities 13 Wholesale trade 14 Business services.

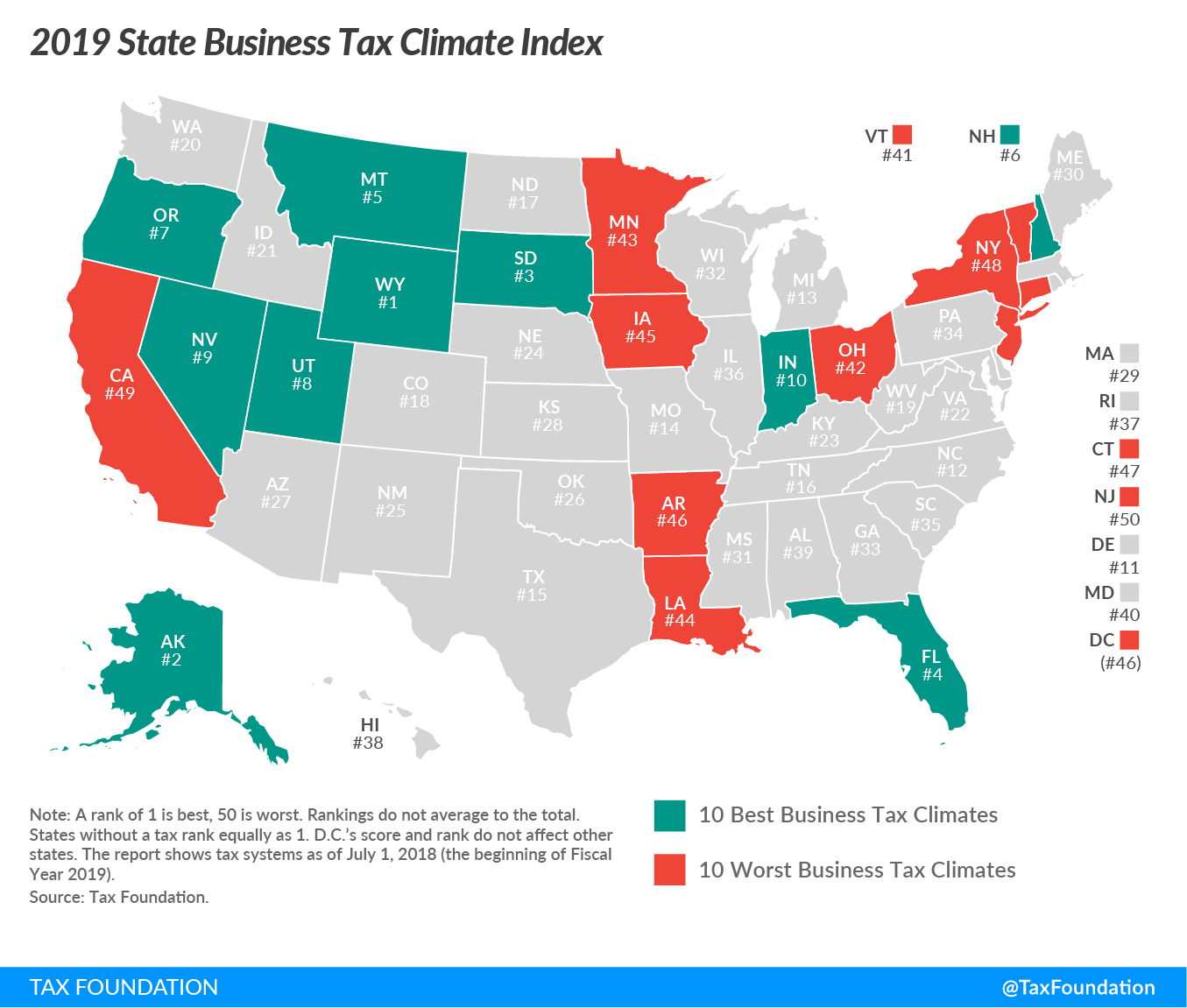

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Is Food Taxable In North Carolina Taxjar

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

![]()

Prepared Food Beverage Tax Wake County Government

Is Food Taxable In North Carolina Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Is Food Taxable In North Carolina Taxjar

Sales Tax On Grocery Items Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

How To Register For A Sales Tax Permit Taxjar

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

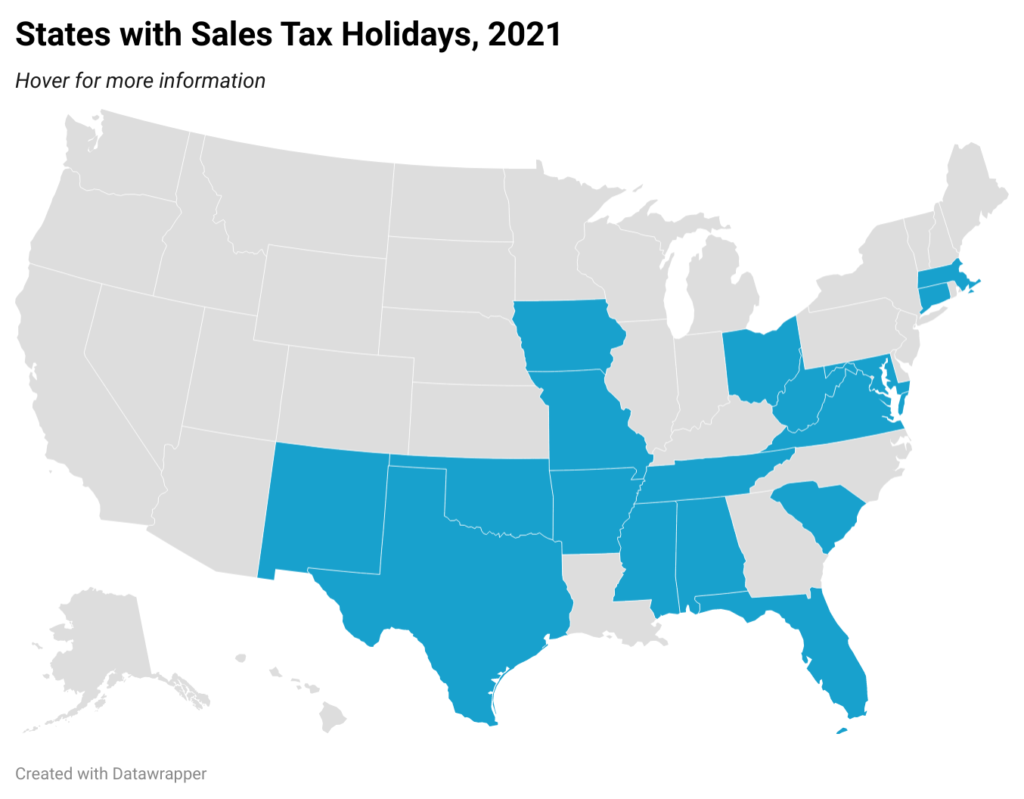

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep